AUBURN — Before introducing legislation that would allow the city of Auburn to implement a tax on hotel stays and short-term rentals, Assemblyman John Lemondes heard from a few opponents of the proposal at a public meeting Thursday.Ěý

Lemondes, R-LaFayette, attended a meeting organized by the Auburn City Council to collect feedback on the proposed hotel tax. The council is seeking the state's authorization to institute a tax of up to 5% on hotel stays and short-term rentals within the city.Ěý

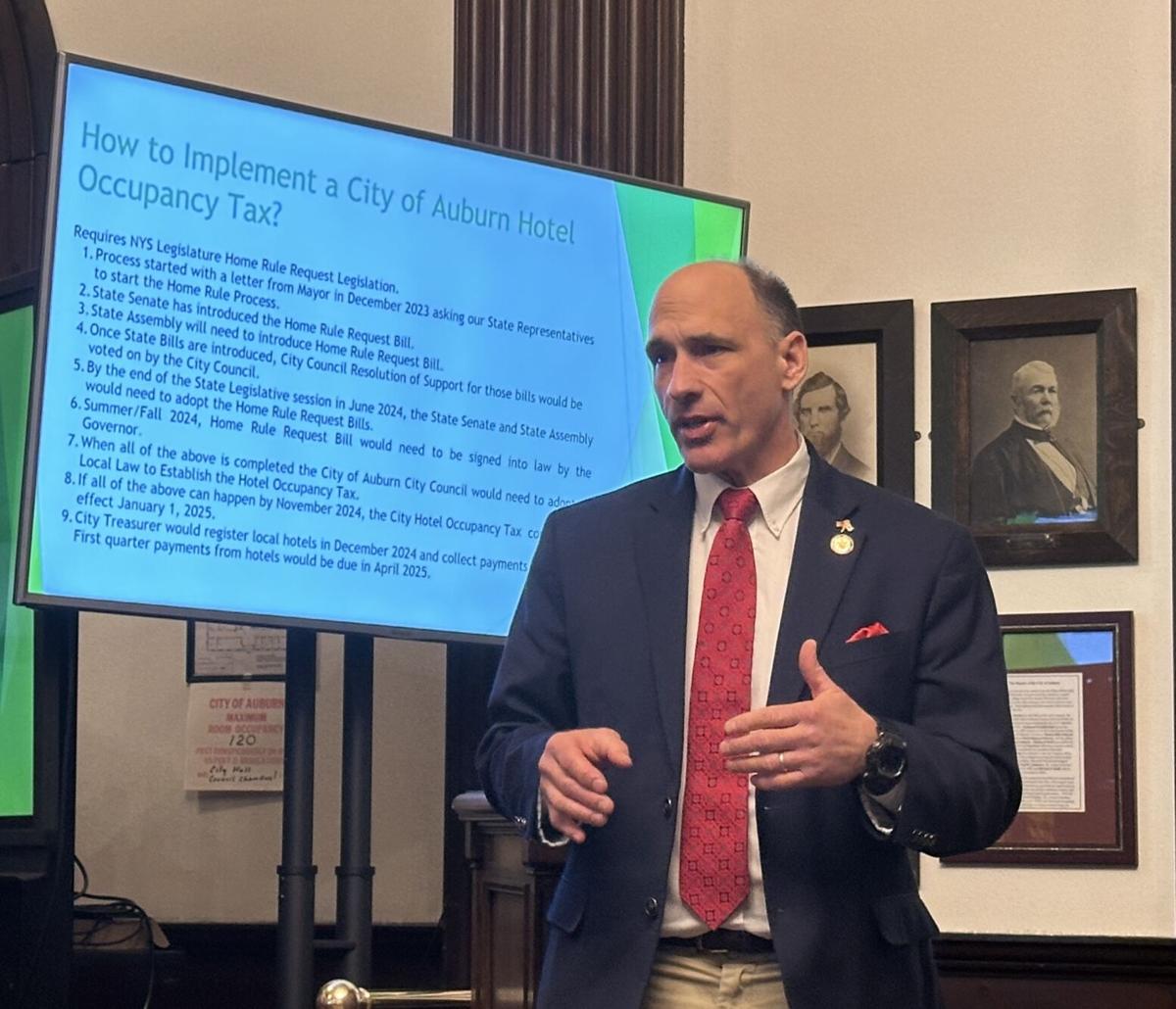

The meeting began with a presentation by Auburn City Clerk Chuck Mason, who detailed why the city may impose a hotel tax. One factor is that nearby cities, such as Geneva and Ithaca, have hotel taxes. When the city learned that fact, Mason said "we felt the time was right."Â

People are also reading…

Cayuga County already has a hotel occupancy tax that has been in place since the 1990s. The revenue from the 5% tax supports the county Office of Tourism. If the city decides to charge a 5% tax, it would be in addition to the county's tax.Ěý

Mason provided an overview of Auburn's popular tourist attractions, along with other events and venues that draw visitors. One example is Falcon Park, the home of the Perfect Game Collegiate Baseball League's Auburn Doubledays. Between the Doubledays and college baseball tournaments, there are numerous out-of-town visitors who attend games at the ballpark and stay at local hotels.Ěý

A hotel tax, Mason explained, would cover costs associated with increasing tourism. The costs include city services, such as ambulance, fire and police, and wear and tear on infrastructure. He projected that if the city sets the hotel tax rate at 5%, it would generate $500,000 in annual revenue.Ěý

By charging a tax on hotel stays and short-term rentals, Mason said it would "lessen the burden on property taxpayers."Â

But the opponents who spoke at the meeting think the tax would drive visitors away from Auburn.Ěý

David Pappert, an Auburn resident who chairs the Cayuga County Conservative Party, worries that the tax will have an effect on other area businesses. If people have to pay more for hotel rooms, he said that's less money they will have available to go to local restaurants or shops.Ěý

"I think we have to be cognizant of that," he said, adding that it's "very unfair to target one industry."Â

Eric Ridley was among the handful of speakers at the meeting. Ridley, who serves as Throop town supervisor, has worked in the hospitality industry — he was the opening general manager at Hilton Garden Inn in Auburn. He also sits on the executive committee of the New York State Hospitality & Tourism Association.Ěý

Ridley described hotels as a "passive piece" of Auburn's tourism economy because visitors are coming for other attractions. He also noted the proposed tax would be in addition to the 8% sales tax and 5% county occupancy tax paid by guests.Ěý

"We already have an elevated tax," he said.Ěý

In December, then-Mayor Michael Quill and his successor, Mayor Jimmy Giannettino, sent letters to the city's state representatives asking them to introduce legislation that would allow Auburn to implement a hotel tax. State Sen. Rachel May, who represents all of Cayuga County, sponsored the bill in January.Ěý

Although Lemondes has not yet introduced the bill in the Assembly, he sponsored legislation last year that authorized the village of Weedsport in Cayuga County and the town and village of Skaneateles in Onondaga County to charge hotel taxes. The bills were signed by Gov. Kathy Hochul.Ěý

Lemondes did not take a position on Auburn's proposed hotel tax. However, he explained why he asked for the meeting.Ěý

"Whenever there's a tax that's new that might be levied, there are people that are for it and people that are against it," Lemondes said. "I wanted everybody to be able to express their opinion for, against or neutral."Â

Constituents who could not attend the meeting can submit comments to Lemondes at his district office, 69 South St., Auburn, or by emailing lemondesj@nyassembly.gov.

Politics reporter Robert Harding can be reached at (315) 282-2220 or robert.harding@lee.net. Follow him on Twitter @robertharding.