The U.S. Education Department has reopened online applications for income-driven repayment plans for student loan borrowers.

The applications were taken down in response to a February court ruling, which blocked the Biden administration’s Saving on a Valuable Education Plan and parts of other income-driven repayment plans. The materials’ removal  for borrowers already enrolled in repayment plans.

The American Federation of Teachers filed a lawsuit seeking to force the department to accept and process applications for repayment plans.

Delays in processing applications held up relief for borrowers, including those enrolled in the , said Persis Yu, deputy executive director for the Student Borrower Protection Center, which represented the plaintiffs.

People are also reading…

"Every day these applications go unprocessed deprives borrowers of critical time toward PSLF relief and financial stability,” Yu said.

The Trump administration needed to revise the income-driven repayment plan application in order to comply with the February ruling, said James Bergeron, acting undersecretary at the Education Department. While the online application was down, officials said there were no disruptions to the paper application process.

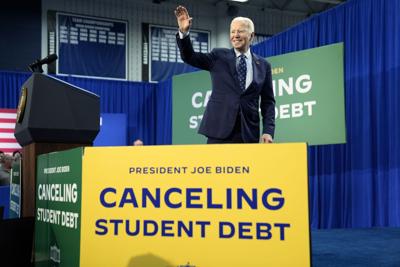

President Joe Biden departs April 8 after delivering remarks on student loan debt at Madison College in Madison, Wis.

Income-driven repayment plans take a borrower’s finances and family size into account when calculating monthly payments, but borrowers must periodically demonstrate they still qualify. When forms were unavailable, some borrowers were unable to complete that process.

Advocates for borrowers encouraged them to be prepared for delays in processing as the department begins accepting applications again.

“Looking at the application today, it does appear that everything is back online,” Sabrina Calazans, executive director of Student Debt Crisis Center, said Wednesday. “Borrowers should still apply for the plan that works for them."

She said borrowers should continue to plan for how to tackle their student debt, despite the Trump administration's . Not paying back loans or meeting payments can result in delinquency and defaults.

“We have heard a lot of people say that if the department is going away, so do their loans. That is not true," Calazans said.

AFT President Randi Weingarten said in a joint statement with the Student Borrower Protection Center that the government “took a step because of our lawsuit to restore some borrowers’ rights” but many borrowers are still met with “red tape, backlogs and dead ends.”

The Education Department's Federal Student Aid office was hit hard by layoffs, with more than . The Trump administration said the cuts won’t affect students and families.

Higher education, higher earnings? Here's where advanced degrees pay off the most.

Higher education, higher earnings? Here's where advanced degrees pay off the most.

A college degree has often been viewed as a ticket to the middle class and a requirement for the increasingly high-tech, high-skill jobs of tomorrow. Software developers, registered nurses, and accountants are some of the occupations requiring a college education that are , according to the Bureau of Labor Statistics.Â

Indeed, jobs that require a bachelor's degree are projected to grow faster than the average across all jobs, with 3.3 million openings each year. The share of jobs that will need at least a college education is also expected to rise: by 2031, compared to 36% in 2021, according to the Georgetown University Center on Education and the Workforce.

As demand for highly educated workers increases, the share of Americans with a college degree has also gone up. In 2022, of Americans 25 years and older had completed four or more years of college, while in 2000, less than 26% had. Some states had even higher shares of college graduates—, per the Federal Reserve Bank of St. Louis. Those two states trailed only Washington D.C. in having the most highly educated population—nearly two-thirds of the residents in the nation's capital are college graduates.

Having a bachelor's degree not only helps qualify graduates for more jobs, but it also qualifies them for higher-paying positions. Those with college degrees enjoy a significant pay increase over those with only a high school diploma. But the size of that increase is not equal everywhere. analyzed to determine the wage boost a college education provides both nationally and by state.

College degrees provide a significant earnings boost

Nationally, college graduates earn significantly more than those with only a high school education or less. This wage gap has widened over time, too. An analysis by the Federal Reserve Bank of St. Louis found that in 1980, a than a high school-educated worker by mid-career. But in 2020, this gap had grown to $18,000. Much of this difference is because jobs that high school graduates work in , whereas college graduates might see their salary increase significantly over the course of their career, according to a study by Harvard University's David J. Deming, published in the National Bureau of Economic Research.

Even within the same occupation, those with a college degree tend to earn more than those with just a high school diploma. A 2023 of jobs that employed a significant number of both high school graduates and college graduates found that the earnings gap ranged from 12% for bookkeeping, accounting, and auditing clerks to 78% for supervisors of nonretail sales workers. The median salary for a nonretail sales supervisor with a college degree was $95,000 compared to just $53,400 for a supervisor with only a high school diploma.

Of course, not all college graduates will earn equally high salaries. What one studies can significantly impact one's financial outcome, as earnings vary significantly across different fields. Those who studied engineering, economics, or finance tended to have a mid-career annual median wage of $100,000 or more, while education, social services, and theology and religion majors had the lowest median wages, earning $60,000 or less annually, according to .

The wage boost is bigger in some states than others

How much of a wage boost a college degree provides also varies by state. The range from around $52,000 in Mississippi, the lowest in the country (except for Puerto Rico), to over $95,000 in Washington D.C. While college graduates earn more than high school graduates in all states, the pay bump is larger in some places, such as D.C., New Jersey, New York, and California, and smaller in others like Vermont, Maine, and Montana.

Some of what drives these differences in educational pay gaps is related to the share of residents employed in high-paying jobs and industries. States with the biggest gaps tend to have a larger share of workers in occupations that both require high levels of education and are well compensated. For example, D.C. has a large number of lawyers (, per the Bureau of Labor and Statistics), a profession that both pays well (average salary of nearly $240,000 in D.C.) and requires an advanced degree.

Not only do these jobs pay more, but workers might also earn some of the highest salaries in their field in states with larger wage boosts. In New Jersey, the average salary of registered nurses, one of the top five jobs in the state, is among the highest in the nation, at nearly $102,000. Similarly, in New York, general and operations managers—the third largest occupation in the state—earn nearly the highest average salaries in their field.

States with larger wage gaps also predict that there will be a growing demand for workers with a college degree. California, for example, projects that some of its will be nurse practitioners, physician assistants, medical managers, data scientists, and information security analysts—all jobs that typically require a college education at minimum.

Vermont, on the other hand, forecasts will mainly be for waitstaff, carpenters, sales representatives, and fitness trainers—these jobs are ones that do not typically require a bachelor's degree. Without strong local demand for their skills and knowledge, it makes sense that college graduates would not earn as much in states like Vermont.

An additional factor that may influence how much of a wage boost a college education provides is institutional prestige. Several studies have shown that graduates from more selective institutions tend to . An analysis of data from more than 1,500 schools by PayScale found that early-career median pay for Ivy League graduates was , compared to around $58,000 for graduates from other institutions—and that the gap grows even wider by mid-career.

Opportunity Insights studied anonymized admissions data and income tax records and found that attending such selective colleges also of being in the top 1% of earners. However, research from Mathematica Policy Research and Princeton University points out that the advantage that attending a highly prestigious institution provides in terms of earnings , suggesting that it isn't so much the quality of the school as much as the quality of the students that affects future earnings.

Although having a college degree can significantly boost one's wages, attending college comes with a hefty price tag, too. In 2023, , owing a median amount of $20,000 to $25,000, according to an analysis of Federal Reserve Board data by the Pew Research Center. It also found that college graduates with student loan debt tend to have lower household incomes than those without debt (though they do still earn more than noncollege graduates).

Perhaps it is not surprising that doubts are growing as to whether attending college is worth it. now think that someone without a degree could potentially get a well-paying job in today's economy, and than it was 20 years ago. As college enrollment declines from a peak of 70% in 2009 to 61% in 2021, it seems that the perceived financial benefits of a college degree may not be as clear-cut as before.

Story editing by Carren Jao. Additional editing by Elisa Huang. Copy editing by Tim Bruns.

originally appeared on and was produced and distributed in partnership with Stacker Studio.